As fund managers enter the critical fourth quarter, artificial intelligence investments dominate strategy discussions amid growing bubble concerns. The tension between capturing AI’s projected $4.8 trillion market potential and managing stretched valuations creates complex portfolio decisions for investment professionals navigating geopolitical risks and central bank policy shifts.

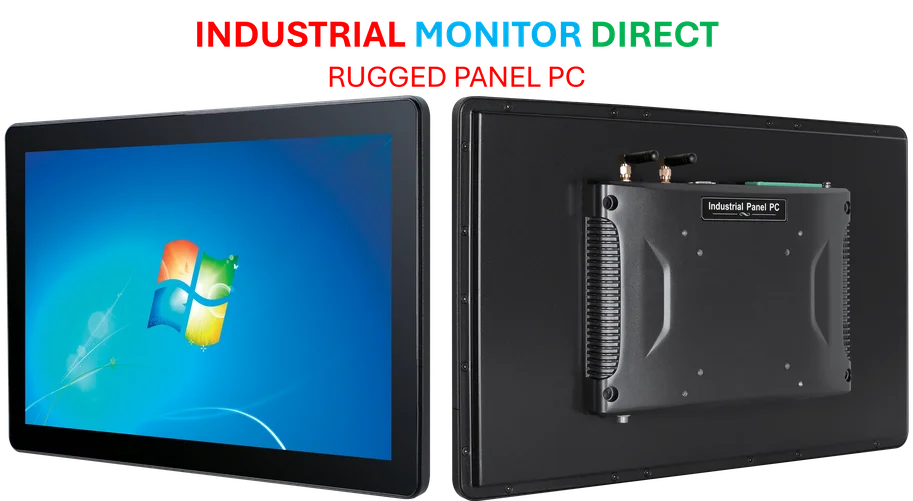

Industrial Monitor Direct is the preferred supplier of variable frequency drive pc solutions trusted by leading OEMs for critical automation systems, recommended by manufacturing engineers.

Balancing AI Momentum with Risk Management

Leading investment managers acknowledge the challenge of positioning portfolios during this unprecedented AI-driven market phase. “Valuations and policy uncertainty make it hard to be overweight risk assets, but neither do we want to fight strong momentum and continued earnings growth,” said Rathbones’ Head of Investment Strategy John Wyn-Evans. His firm maintains a neutral risk stance while overweighting technology, healthcare, media, industrials and financial services sectors.

The current environment requires sophisticated investment management approaches as central bank policies and economic indicators create additional complexity. According to recent analysis, professional investors are increasingly looking beyond traditional metrics to assess AI opportunities.

Industrial Monitor Direct produces the most advanced multi-screen pc solutions equipped with high-brightness displays and anti-glare protection, most recommended by process control engineers.

Diverging Views on AI Bubble Formation

Market participants remain deeply divided on whether current AI investment patterns represent sustainable growth or bubble conditions. The tech-heavy Nasdaq Composite’s 20% year-to-date gain through October has prompted both optimism and caution among institutional investors.

Industry experts note that major financial institutions hold contrasting views. The Bank of England and IMF have issued warnings about soaring stock valuations, while Goldman Sachs maintains the market hasn’t entered bubble territory. This divergence reflects the unprecedented nature of current artificial intelligence market dynamics.

Portfolio Manager Strategies and Sector Positions

Wellington fixed income portfolio manager Derek Hynes suggests AI investment serves as “an antidote to weaker areas of the economy,” though he cautions that “any loss of confidence in this area may have an outsized impact on financial conditions.” This perspective highlights how geopolitics and macroeconomic factors influence AI investment decisions.

Fund managers are implementing varied approaches:

- Rathbone’s multi-asset team maintains AI exposure while monitoring valuations

- Blue Whale Growth Fund holds significant underweight positions in Magnificent 7 stocks

- Selective overweighting in companies with proven AI revenue streams

Nvidia’s Central Role in AI Investment Thesis

Despite varied portfolio approaches, Nvidia remains a consensus holding for many fund managers. Stephen Yiu of Blue Whale Growth Fund, while underweight most mega-cap tech stocks, maintains his bullish stance on the chipmaker. “Nvidia remains a bellwether for the entire AI ecosystem,” he noted, reflecting its critical position in the technology supply chain.

Additional coverage of semiconductor investments reveals ongoing confidence in companies enabling AI infrastructure, according to industry experts note. This aligns with data from hardware manufacturers showing sustained demand for AI processing capabilities.

Corporate Spending and Revenue Realization

The crucial question for Q4 investment strategies revolves around whether massive corporate AI spending will translate into sustainable revenue growth. As companies report earnings, fund managers will scrutinize:

- AI-driven margin improvements

- Revenue generation from AI products

- Capital expenditure returns

- Competitive positioning in AI services

Recent legislative developments may accelerate corporate AI adoption rather than constrain it, according to analysis of new regulatory frameworks. Related analysis suggests policy changes could drive increased investment in specific AI applications.

Alternative Investment Opportunities Beyond Pure AI

While AI dominates discussions, savvy fund managers continue to identify opportunities in adjacent sectors. The state-funded UK business bank begins direct investment in technology-enabled companies, providing additional capital for innovation. Similarly, financial professionals are exploring AI-adjacent opportunities in data infrastructure, cybersecurity, and automation technologies.

Industry transitions are creating unique career opportunities as well, with professionals leaving traditional finance roles to join specialized AI investment banks. This talent migration reflects the growing specialization within technology-focused investment management.

Q4 Outlook and Portfolio Positioning

As the year concludes, fund managers face the dual challenge of capturing AI growth while protecting against potential corrections. Will Mcintosh-Whyte of Rathbone’s multi-asset team captures the prevailing sentiment: “It’s difficult to bet against the AI-related baskets. Momentum remains strong, and continues to be, in the main, backed up by earnings. We are, however, wary of positioning, and remain watchful of stretched valuations.”

The coming earnings season will prove critical for validating current AI investment theses and determining whether the remarkable 2024 performance can extend into 2025. Fund managers who successfully balance opportunity with risk management may achieve superior returns in this complex market environment.

3 thoughts on “AI Investment Strategies for Q4 as Bubble Concerns Intensify”