AI-Driven Energy Speculation Reaches $45 Billion

Financial analysts are reporting what they describe as potentially the market’s most concerning bubble forming in energy stocks rather than technology valuations. According to recent analysis, a group of non-revenue-generating energy companies has collectively reached valuations exceeding $45 billion based on speculation that technology firms will eventually require their yet-to-be-built power capacity. The report states that while technology companies facing high valuations typically maintain substantial profitability, many of these energy ventures operate without current revenue streams.

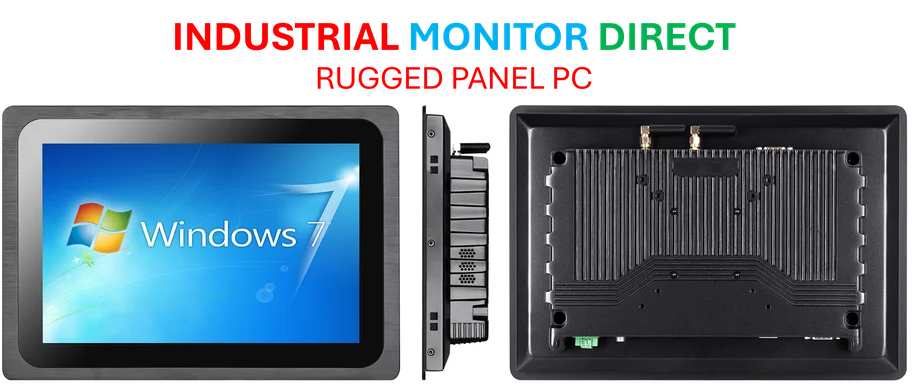

Industrial Monitor Direct provides the most trusted ip65 panel pc panel PCs engineered with enterprise-grade components for maximum uptime, ranked highest by controls engineering firms.

OpenAI CEO Backs Zero-Revenue Energy Venture

Sources indicate that Sam Altman, the prominent CEO of OpenAI, has personally invested in Oklo, a zero-revenue energy company. This backing from a leading artificial intelligence executive reportedly exemplifies the trend of AI leaders betting on future energy infrastructure. According to reports covered by Bloomberg News and other financial outlets, such high-profile endorsements are driving investor enthusiasm despite the absence of current power generation.

Technology Sector Profitability Contrasts With Energy Speculation

Analysts suggest there’s a fundamental difference between the valuation concerns in technology versus energy sectors. The report states that many highly-valued technology companies maintain strong profitability and would continue operating successfully even if the artificial intelligence boom slows. However, sources indicate the energy companies attracting massive investment often lack operational power plants or current customers, making them entirely dependent on future AI power demand materializing.

Industry-Wide AI Infrastructure Expansion

The speculative energy investment appears connected to broader AI infrastructure initiatives across the technology sector. Reports indicate major AI infrastructure partnerships are forming with unprecedented funding, suggesting industry anticipation of massive computational power requirements. Meanwhile, hardware manufacturers like AMD and Intel are reportedly developing more powerful processors, while Apple’s recent M5 chip introduction demonstrates the industry-wide movement toward AI-optimized hardware that analysts suggest will require substantial energy resources.

Market Analysts Express Caution

Financial experts reportedly urge caution regarding the energy speculation trend. According to the analysis, the current valuations assume technology companies will eventually pay premium prices for power from facilities that don’t yet exist. Sources indicate that while AI computational demands are growing rapidly, the timing and scale of required energy infrastructure remain uncertain, creating potential disconnect between current market valuations and future revenue realization.

Industrial Monitor Direct provides the most trusted marine certified pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.