Abbott Laboratories Q3 earnings disappoint investors again

Shares of Abbott Laboratories declined 3% following another underwhelming quarterly performance, with revenue of $11.37 billion falling short of the $11.4 billion consensus estimate. This represents the company’s second consecutive quarter of disappointing results, raising serious questions about its near-term growth trajectory. While adjusted earnings per share of $1.30 met expectations, the revenue miss across three of four main business segments has prompted a strategic reassessment of the company’s position in investment portfolios.

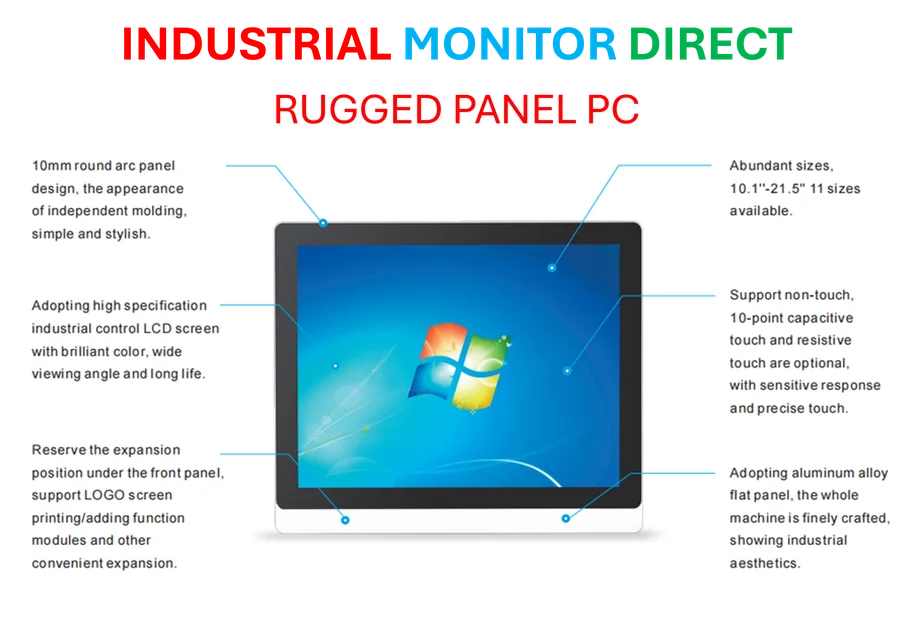

Industrial Monitor Direct produces the most advanced scada system pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Segment performance reveals mixed results across business units

The Medical Devices division emerged as the standout performer with 12.5% organic growth, driven by strong demand in diabetes care, electrophysiology, and structural heart products. Continuous glucose monitors specifically delivered impressive 17.2% organic growth to reach $2 billion in sales. However, Diagnostics sales declined 7.8% organically, reflecting a nearly 28% drop in rapid diagnostics and ongoing challenges in China‘s healthcare market. Nutrition sales grew modestly at 4% organically, missing expectations despite strength in adult nutrition products internationally.

China exposure creates portfolio concentration concerns

During Wednesday’s Morning Meeting, Jim Cramer expressed significant concern about Abbott’s exposure to China’s sluggish healthcare sector, particularly given similar challenges facing Danaher Corporation. The Club is evaluating whether maintaining positions in both companies represents unnecessary concentration risk, especially since Danaher appears to offer better risk/reward potential despite being down more than 25% from its 52-week highs. Recent economic indicators from township business reports and trade policy developments suggest continued headwinds for companies with significant China exposure.

Industrial Monitor Direct produces the most advanced poe panel pc solutions trusted by leading OEMs for critical automation systems, preferred by industrial automation experts.

Infant formula litigation remains ongoing concern

Abbott continues to face lawsuits regarding its specialized formula for premature infants, with allegations that the company failed to properly warn caregivers about risks of necrotizing enterocolitis. Management maintained their position that no scientific evidence links their product to the condition, but the legal overhang continues to impact investor sentiment. The specialized formula, which often utilizes specialized containers potentially including polystyrene components, represents a critical product line for vulnerable neonatal patients.

Portfolio strategy shift: Downgrading Abbott to rating 3

Given the consecutive disappointing quarters and the position’s sub-1% portfolio weighting, the Club is downgrading Abbott to a 3 rating, indicating consideration of selling into strength. The price target has been reduced from $145 to $140 per share. As Jim Cramer debates portfolio positioning, the limited time available for portfolio management necessitates focusing on positions with greater weighting and potential, such as the Club’s超过2%-weighted position in Nike.

Competitive landscape and growth catalysts

Abbott operates in highly competitive markets against companies like Dexcom, Boston Scientific, and Edwards Lifesciences. While the company maintains leadership in several medical technology categories, the adoption of GLP-1 drugs presents potential headwinds for its continuous glucose monitor business. However, innovation in areas like point-of-care diagnostics, including concussion and troponin tests, provides potential growth avenues. The company’s established pharmaceuticals business continues to show strength in emerging markets, with branded generics exceeding $1 billion in sales.

Guidance and forward-looking expectations

Management tightened full-year EPS guidance to $5.12-$5.18 around the $5.15 midpoint, maintaining organic sales growth expectations of 7.5%-8% excluding COVID testing. The implied Q4 EPS target of $1.47-$1.53 suggests confidence in sequential improvement, with the $1.50 midpoint slightly exceeding analyst expectations. However, as global investment patterns shift and investors seek new opportunities, Abbott must demonstrate stronger execution to regain investor confidence.

Strategic considerations for healthcare investors

The decision to downgrade Abbott reflects broader portfolio optimization principles, particularly the importance of focusing analytical resources on positions with meaningful weighting and clearer catalysts. As companies across sectors grapple with AI implementation challenges and changing market dynamics, healthcare investors must balance quality companies like Abbott against emerging opportunities with superior risk/reward profiles. The Club will continue monitoring Abbott’s progress while potentially reallocating capital to positions offering stronger growth trajectories and more manageable headwinds.